We Are Here To Help

Here To Help

Telehealth, E Visits, Reimbursement and More…

We know this is an extremely difficult time to be a business owner and that each day brings new challenges for you and your clinics.

Now more than ever, it is important to focus on your Revenue Cycle and clean up your AR and make sure you are collecting every penny that you've earned.

If you are continuing to see patients in the clinic and/or via telehealth, we can assist getting you set up with your payers and also with billing out your current claims to ensure payment as quickly as possible.

We want to be a resource in any way that we can. Let's band together and continue to operate in one of the best communities in healthcare. We are here to help.

Transitioning to Teletherapy

Transitioning to Teletherapy

Information, interpretations and opinions seem to be falling from the sky regarding Medicare, teletherapy, e-visits, reimbursement and when and how these visits should be billed.

We are currently assisting our partners through the transition to teletherapy and we are here to help you too.

If you would like to schedule a call to discuss teletherapy and your practice, please contact us today.

COVID-19 and Part B Updates

CMS has released additional guidance on COVID-19 and Medicare Part B. You can read more here.

Here are a few important additional updates:

Medicare Advantage plans may provide their enrollees with access to Medicare Part B services via telehealth in any geographic area and from a variety of places, including beneficiaries’ homes. Medicare Advantage Organizations can expand coverage of telehealth services beyond those approved by CMS.

It is essential to verify with all insurances ahead of time whether or not they cover telehealth. If an insurance company says they will not cover telehealth, you can choose to see the patient via telehealth and appeal if the visit does end up being denied. This is a fluid situation and the insurance company is likely updating their policies in real-time. You can also offer patients self-pay for telehealth services.

The Coronavirus-19 Emergency Declaration Health Care Providers Fact Sheet lists multiple waivers that will help providers see patients in a more efficient and timely manner. This temporarily waives requirements for out of state providers to see patients and postpones revalidation requirements. You can read more here.

We will do our best to provide any updates from CMS and commercial insurance companies as they are released. The safety and health of your patients and of your teams is our main concern and we will continue to be in communication as this situation moves forward.

COVID-19 and Telemedicine

We have had several of our partners reach out to us to ask about the possibility of providing telehealth as Coronavirus continues to spread across the country.

The answer to that question is extremely complicated and fluid.

Many practices have already instituted telemedicine to help eliminate barriers to care for patients. However, not every insurance payer is willing to cover these telehealth visits.

As of this moment, telehealth is NOT a widely covered benefit under the Medicare fee schedule. Each commercial payer has different regulations and fee schedules regarding reimbursement and telemedicine and these regulations differ by each state. Each state’s practice act may also have restrictions on whether or not you can provide telehealth.

If you are inquiring with your top payers about telemedicine, let them know where your originating site will be (home or office) to verify whether it will be covered. There may be additional questions and restrictions regarding the care you can provide via telemedicine.

We will continue to keep you updated on if CMS temporarily changes course to include specific specialties as a covered telemedicine benefit and on any other payer news regarding telemedicine. As always, we are here for you as a resource and are happy to answer any questions you may have on this topic.

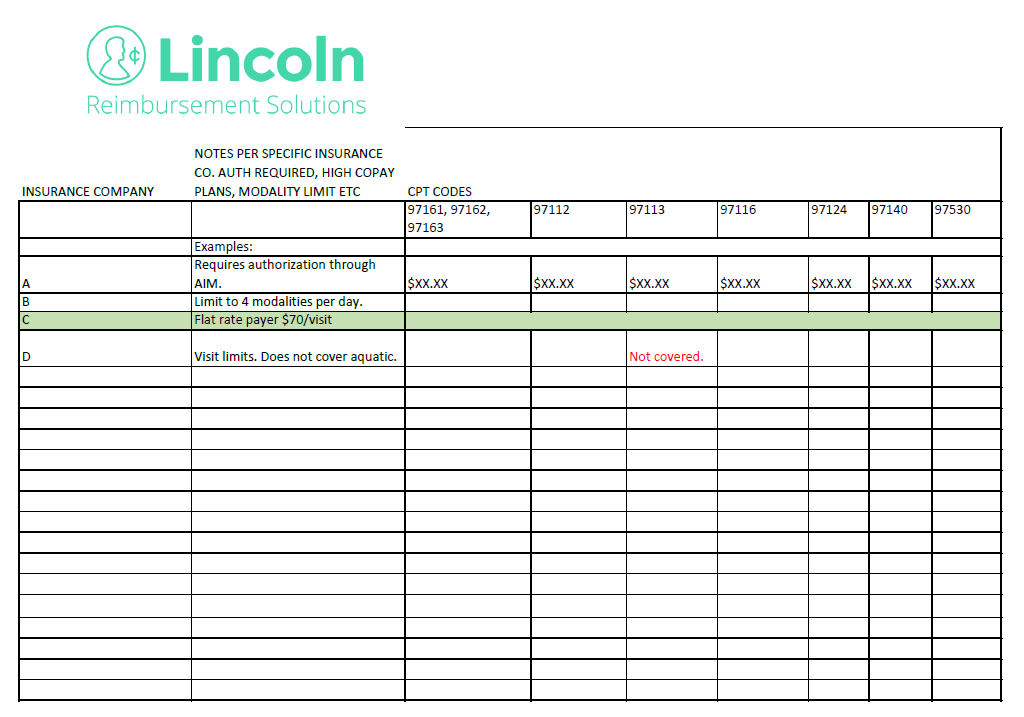

Downloadable Payer Cheat Sheet Template

Insurance companies are constantly updating, altering, reversing, swerving and dodging paying you in any and all ways that they can!

Your billing team plays a pivotal role in addressing these challenges and alerting the leadership team to what they are seeing on insurance payment EOBs.

To help assist you and your team, we created a Payer Cheat Sheet that your billing team can complete for your practice. Your clinical team can then use this cheat sheet to adjust payer and billing guidelines in your EMR to ensure you are optimizing your coding.

This file is best created in Excel. Contact us at hello@lincolnrs.com and we share the template and/or help get you started!

Is Your Prior Authorization Process Up to Speed?

Insurance companies are not going to stop requiring prior authorization. In fact, insurance companies are increasing their prior auth requirements including Anthem Blue Cross Blue Shield and United Healthcare.

New Prior Auth Requirements for Anthem Blue Cross Blue Shield

We are seeing several commercial plans across the country implement strict prior authorization requirements. We wanted to share a few examples of specific plans but even if these plans haven’t changed requirements in your state yet, you can bet these or other plans will be implementing similar requirements as the year goes on. Effective November 1, 2019, Anthem Blue Cross patients in over a dozen states require prior authorization to receive outpatient physical, occupational and speech therapy services. The initial evaluation does not require prior authorization, but treatment provided on the same date of service as the initial evaluation may require prior authorization depending on the payer rules.

This new program is being overseen by AIM Specialty Health. AIM’s Rehabilitation Program provides a clinical appropriateness review process that encompasses the duration of rehabilitation services. The program includes review of rehabilitative and habilitative outpatient physical, occupational and speech therapy services for medical necessity. The AIM Rehabilitative program for Anthem’s Commercial Membership will relaunch April 1, 2020 for Colorado and Nevada. The AIM Rehabilitative program for Anthem’s Medicare Advantage membership will launch April 1, 2020 for: California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, New Hampshire, New York, Ohio, Tennessee, Texas, Virginia, Washington, Wisconsin and Texas.

New Prior Auth Requirements for United Healthcare

Similarly to Anthem, UnitedHealthcare Community Plan has announced they will implement prior authorization for outpatient physical, occupational and speech therapy services in select states. This process has already begun in many states. In addition, UnitedHealthcare Community Plan has announced they will be conducting site of service medical necessity reviews for all speech, occupational and physical therapy services in select states. For some states, the member’s referring physician will be required to submit prior authorization requests for evaluations and re-evaluations.

Once the physician has submitted the request for an evaluation or reevaluation and the request has been approved, the therapy provider can then request therapy visits. In the past, the prior authorization requests were submitted by the therapy provider. If UnitedHealthcare Community Plan does not have the authorization on file prior to the initiation of therapy services, therapy services will be denied and the provider will be unable to balance bill the patient. Additional prior authorization requirements are coming for UHC MyCare plans later this year.

What Can You Do About New Prior Auth Requirements?

Verifying a patient’s insurance is essential. By verifying a patient’s insurance prior to their appointment, you can estimate their patient responsibility, provide them visit limits, and know if their plan requires prior authorization or authorization. These requirements can be a lot for a front desk staff person to handle. LRS can help reduce these significant administrative burdens by taking on your verifications and authorizations so that your front desk can focus on the customer service experience for patients in your facility. Want to learn more about how LRS can assist in your verification and authorization process? Reach out to hello@lincolnrs.com and we can set up a time to chat!

Come Visit LRS at CSM!

The APTA CSM conference in Denver is almost here! If you or anyone in your organization are planning on attending, be sure to swing by Booth #2324 to say hello and find out how LRS might help to increase your revenue and decrease your administrative headaches!

Here are the exhibit hall hours for your reference:

Thursday, February 13th, 9:30 AM - 4:00 PM

Friday, February 14th, 9:30 - 4:00 PM ♥️

Saturday, February 15th, 9:30 AM - 3:00 PM

Interested in having coffee or a drink with us while at CSM? Email bjohnson@lincolnrs.com to set up a time!

Is Your EMR in Transition? 6 Tips to Help You Navigate

There have been so many changes in the physical therapy EMR world over the last few months - mergers, acquisitions, and overall instability when it comes to knowing who is managing your billing software.

We know the transition of an EMR can bring dread to you and your team. Luckily, LRS is here to help you navigate these transitions and ensure your revenue stream experiences no delays.

Here are 6 tips to help you survive (and thrive!) through an EMR transition:

Identify Existing Operational Issues: You want to start clean in your new system. If you are receiving denials for not verifying patient insurance correctly and subsequently missing authorizations, those same issues will carry over to a new system. Now is the chance to make sure all of your up-front processes are in place so you can be set up for success in your new EMR.

Allow Yourself Enough Time: Make sure you and your whole team take all available trainings in the new system, are practicing getting acquainted with flow of the software, and that you move your schedule and caseload over from your current software prior to your go-live date. You also want to make sure your billing partner is ensuring all billing rules, fee schedules, modifiers, etc. are set up correctly in the new system.

Plan for Your Old A/R: Who is going to work the claims in your old EMR system? If you have an in-house biller, this is self explanatory but ensure that you have access to the old EMR system for long enough to continue to work claims. If you are switching to a new billing company, what is your contract with the old system? Who owns the ability to work that A/R? Have these conversations early to avoid confusion down the line.

COMMUNICATE!: This cannot be overstated. Communicate with your old software support team, new software support team, your internal operational team, your billing team, your clinical team - integrate and communicate at all levels to ensure each team member has what they need to successfully complete their duties in the new system.

Monitor Your KPIs: Before you transition, identify your Key Performance Indicators. These should be first pass payment rates, revenue/visit, and other key metrics for your practice. Monitor these during the transition to ensure all essential KPI numbers are being met.

Focus on the Patient, Not the Computer: Above all, patient care comes first. Allow your billing partner, like LRS, to help you navigate the transition so you can do what you do best - take care of your patients.

Thinking about transitioning your software? Contact hello@lincolnrs.com to learn how LRS can help support you through the change.

Are You Attending CSM 2020?

The APTA Combined Sections Meeting is being held next month in Denver.

LRS will be there! Will you?

We would love to have the chance to buy you a cup of coffee and chat about how we might be able to help improve your revenue cycle. If you plan on attending, let us know by filling out the below form and we will contact you to set up a time to meet.

BREAKING NEWS: CMS Reverses NCCI Eval Coding Change

As you know on January 1st, 2020 CMS changed its coding methodologies to prevent PTs and OTs from billing an evaluation and therapeutic activities and/or group therapy services on the same date of service.

But as of today, January 24th, 2020, CMS has reversed course and announced that it will return to most of the coding rules that were used in 2019. In short, this means that therapeutic activities (97530) and all PT and OT evaluations may be billed in the same visit without the use of a modifier.

There are still a lot of details to be worked out and we don't know if the update will be retroactive to January 1st... so stay tuned!

Webinar Download: No One Wants to Pay You!

Fill out the form below and LRS’ latest webinar: No One Wants to Pay You! will be available to watch and also emailed to the address provided.

Reminder: After watching the webinar, click here to set up a FREE strategic revenue consultation!

Should You be Using Cash or Accrual Basis Accounting?

Unless you were an accounting major, even the thought of crunching numbers can be daunting. We are here to help you understand the nuances of cash and accrual accounting and to see which may be best for you and your practice.

Let’s start off by breaking down the difference between cash basis accounting and accrual basis accounting.

Cash accounting recognizes revenue and expenses when money is actually paid in and out.

Accrual accounting recognizes revenue when it’s earned and expenses when they’re billed (but not paid). Accrual records revenues on the books when billed to patients, insurance companies, and other third party payers and expenses are recorded when incurred and there is an obligation to pay.

In summary, the major difference is the timing of when sales and purchases are recorded.

So which method is best?

The industry standard is definitely a cash method of accounting. This is because practices use their financials to compare to their operations to see how their practice is doing. Cash is much more straightforward and not nearly as dependent on forecasting. Cash method will show if operations in is line and/or your overhead is too high for your revenues on a month to month basis.

Accrual accounting is more difficult to perform, but may give a more accurate gauge of the practice within any given period. Accrual accounting will allow you to predict what you will collect in any given month on the visits and units that were actually delivered and compare it to the labor that was actually provided in that month. One of the keys in accrual basis accounting is to maintain an accurate bad debt percentage and accurate payment per visit per payer. These key metrics will help ensure that your books are accurately reflecting the health of your business day to day.

While this introduction highlights the major differences between the two methods, you still may have questions about which is best for you and your practice. Contact LRS today to see how we can help you get you to where you need to be to create your 2020 budget and beyond!

NCCI Coding Reminders for 2020

A few coding reminders for physical and occupational therapists that are effective as of 1/1/2020:

NCCI Edits for Evaluations:

97530 and Evaluations

97530 cannot be billed on the same day as physical or occupational therapy evaluations. This was buried deep in the NCCI coding edits changes and it is a major change to how evaluations will be billed moving forward.

97140 and Evaluations

Modifier 59 is required on the evaluation CPT code or on 97140 when you bill manual therapy on the same date of service as a physical or occupational therapy evaluation.

*Please note on changes above, Medicare is considering manual therapy as part of the evaluation CPT code.

Biofeedback Edits

90912: Cannot bill with 90901

90912: Use modifier 59 on the following CPT codes when used on same day: 97032, 97110, 97112, 97530, 97535, 97750

90913: Cannot bill with 90901

90913: Use modifier 59 on the following CPT codes when used on same day: 97032, 97110, 97112, 97530, 97535, 97750

You can review other NCCI changes directly through CMS.

PTA/OTA Modifiers for Medicare:

All therapy services provided by a Physical Therapy Assistant (CQ) or Occupational Therapy Assistant (CO) must be reported with the associated modifiers on the claim line(s) representing the services they provided.

The PTA/OTA modifier must FOLLOW the GP or GO professional modifiers.

All other modifiers are to go after any additional modifiers that are necessary on the claim.

Just as a reminder, Part B Threshold for 2020 for OT is $2080 and for PT/SLP is $2080 (combined).

As always, if you have any questions about these changes or any other 2020 updates, contact us at hello@lincolnrs.com to set up a strategic evaluation meeting.

2019 Blog Highlights

LRS would like to wish you a happy and healthy start to the New Year!

We also wanted to take this opportunity to highlight the most accessed LRS blogs of 2019 in case you missed one:

Cheers to 2020!

Is Your Medicare Documentation Ready for 2020?

Is Your Medicare Documentation Ready for 2020?

2020 is almost here and so are the updates to Medicare’s CPT codes, modifiers, deductibles and payments.

Below are major updates that physical and occupational therapists should be aware of heading into the New Year:

Medicare Part B Deductible

$198.00 in 2020. This is a $13 increase from last year. The patient will be responsible for this portion in addition to the 20% coinsurance. However, if the patient has a secondary insurance, it may also pick up the deductible. It is important to verify this before a patient is seen at the beginning of the year.

New CPT Codes for 2020

90912

90913

97129

97130

Deleted CPT and HCPCS Codes in 2020

64550

95831

95832

95833

95834

G0515

G8978 through G8999; G9158 through G9176; and G9186

New PTA/OTA Medicare Modifiers for Medicare Claims

CQ Modifier: Outpatient physical therapy services furnished in whole or in part by a physical therapist assistant.

CO Modifier: Outpatient occupational therapy services furnished in whole or in part by an occupational therapy assistant.

It is important to note that starting in 2022, if the PTA or OTA provides 10% or more of the treatment session, CPT codes that have a CQ or CO Modifier will be paid at 85% the rate of what a PT or OT would receive for those services. This delay in payment reduction was a major policy win in 2019 but it is important to continue to pressure CMS to delay that increase indefinitely.

Under the Medicare law, the CQ and CO modifiers do not apply to Medicare Advantage plans. However - you should still have your verification team ask each insurance company if they are independently requiring the additional modifiers or will be in the future.

Have questions about these updates? Email us at hello@lincolnrs.com to see how LRS can help.

8 Minute Rule - AMA or CMS?

8 Minute Rule - AMA or CMS?

Unfortunately, very few therapists understand the core differences between billing for insurances that follow AMA guidelines and insurances that follow CMS guidelines. Within your EMR, you should be able to set up and customize the billing and payer settings to ensure you are billing accurately and getting reimbursed properly for the services you have rendered.

8-Minute Rule Cheat Sheet:

Please note: It is important for you or your billing team to verify with each insurance carrier to determine which guidelines they follow.

Before addressing the 8 minute rule, it is imperative to understand the difference between service-based CPT codes and time-based codes. Short and sweet, here’s a breakdown:

Service Based codes can only be billed once per treatment session, no matter how long the procedure takes.

Examples:

physical therapy evaluation (97161, 97162, or 97163) or re-evaluation (97164)

hot/cold packs (97010)

electrical stimulation (unattended) (97014)

Time Based codes are codes that are billed in 15 minute increments and billed based on how long the procedure takes.

Examples:

therapeutic exercise (97110)

therapeutic activities (97530)

manual therapy (97140)

neuromuscular re-education (97112)

gait training (97116)

ultrasound (97035)

iontophoresis (97033)

electrical stimulation (manual) (97032)

Now to the fun stuff... How do CMS and AMA guidelines differ?

CMS:

Per CMS, in order to bill one unit of a timed CPT code, you must perform that associated modality for at least 8 minutes. Medicare takes the total time spent in a treatment session and divides by 15 to figure out how many units are rendered on a given service date. If eight or more minutes are left over, you can bill that time as an additional unit. If 7 or less minutes are left over, you must drop those minutes and not bill for them. Simply put, Medicare takes total time and uses the chart below to determine how many units were rendered on a particular treatment session.

8-22 minutes : 1 unit

23-37 minutes : 2 units

38-52 minutes : 3 units

53-67 minutes : 4 units

68-82 minutes : 5 units

83 minutes+ : 6 units

American Medical Association (“AMA”):

The main difference under AMA guidelines is that the AMA does not calculate the total time or cumulative time of a treatment session. They consider each unit and each unit must be at least 8 minutes in order to bill for it. This is why some people call the AMA guidelines the “Rule of 8’s.”

Some Examples for Understanding:

You bill 97530 for 8 minutes and then bill 97110 for 8 minutes = 2 units billed under AMA guidelines. *1 unit billed under CMS guidelines.

You bill 97530 for 16 minute and then bill 97110 for 7 minutes = 1 unit billed under AMA guidelines. *2 units billed under CMS guidelines.

You bill 97530 for 8 minutes, 97110 for 8 minutes and 97112 for 8 minutes = 3 units billed under AMA guidelines. 2 units under CMS guidelines.

Avoiding 8 Minute Rule Mistakes:

First and foremost, you want to make sure you have customized your software so that it can handle all the intricacies of accurate billing. Since payers are unique to each region, it is imperative you determine which rounding rule various insurances are following.

This determination is one component of the strategic assessment LRS provides its clients, along with continuous updates and adjustments to stay ahead of the curve.

Contact us to Set up a free assessment of your practice.

Webinar Download: Are Administrative Burdens Keeping You From Making Money?

Fill out the form below and LRS’ latest webinar: Are Administrative Burdens Keeping You From Making Money will be available for download and also emailed to the address provided.

Reminder: After watching the webinar, click here to set up a FREE strategic revenue consultation!

Are You Confused by Credentialing? LRS is Here to Help!

What is Credentialing?

Credentialing is a complex process in which providers submit their qualifications, education, training and experience in order to bill an insurance company for reimbursement. Other terms used interchangeably with credentialing are provider enrollment and contracting.

What does the credentialing process involve?

Becoming credentialed involves obtaining, filling out, and submitting a series of applications with insurance companies. Once your applications have been submitted, you must confirm it has been received and follow up frequently to ensure the process is progressing. Although it might sound fairly straightforward, the process is rarely uncomplicated.

Many providers find their enrollment applications rejected or denied for various reasons. Failing to complete a section or submit a document can cost many lost hours and ongoing effort to resubmit applications.

The credentialing process must be repeated for each and every insurance company you wish to submit claims. On average, a provider can expect the credentialing process to take 90 to 120 days. Most providers would describe the process as burdensome, as it draws time away from patient care and puts strain on office administrators.

Consider the use of a credentialing service to alleviate the stress that credentialing puts on providers and office staff!

For some practices, it’s a no-brainer to hire a credentialing service to handle all credentialing needs start to finish. A dedicated credentialing team can focus their energy on submitting, following-up and ensuring all credentialing is accurate and up to date, allowing you to focus on the patient!

A reputable credentialing service will:

Get your practice and providers set up on the Center for Affordable Quality Healthcare (CAQH).

Ensure all CAQH information is up to date at all times. Including but not limited to: education, work history, reattestations, license expirations, and liability insurance. This prevents insurance companies from denying your application due to outdated information.

Save you days of backlog when multiple re-credentialing applications are due simultaneously

Ensure all credentialing applications and documents are accurate and current, therefore decreasing wait times and increasing revenue!

Handle all communication and follow-up. An excellent credentialing service will confirm receipt of all applications and documents and follow-up at least every 2 weeks to ensure the process is progressing. Frequent follow-up prevents an application being stuck in limbo for weeks.

Give you peace of mind that all your credentialing needs are met in a timely and organized fashion.

Don’t spend another minute confused on credentialing (it could be costing you not just time but money!) Contact Lincoln Reimbursement Solutions today to schedule a time to chat with our knowledgeable credentialing team.

PTs: What Does the CMS 2020 Final Rule Mean for You?

On November 1st, the Centers for Medicare & Medicaid Services (CMS) issued its final policies for the 2020 performance year of the Quality Payment Program (QPP) via the Medicare Physician Fee Schedule (PFS) Final Rule.

The 2020 performance year will maintain many of the requirements from the 2019 performance year, while providing some needed updates to both the Merit-based Incentive Payment System (MIPS) and Advanced Alternative Payment Models (APMs) tracks to continue reducing burden, respond to clinician and stakeholder feedback, and align with statutory requirements. Additionally, CMS is finalizing its MIPS Value Pathways participation framework that beings in the 2021 year.

So what does this mean for you and your practice as you head into 2020?

The final rule, which is mostly unchanged from the proposed rule put forward in July, cuts payments to physical therapists by 8% in 2021.

The 2020 therapy threshold dollar amount for physical therapy and speech-language pathology services combined is $2,080 and is a separate $2,080 for occupational therapy services. This is an increase of $40 from the 2019 threshold.

CMS estimates the 2020 conversion factor to be 36.0896. This is a 0.14% increase from the 2019 conversion factor.

One big win from the original proposed rule was that CMS revised the PTA/OTA modifier requirement. Under the final rule, it will allow separate reporting, on two different claim lines, of the number of 15-minute units of a code to which the therapy assistant modifiers do not apply, and the number of 15-minute units of a code to which the therapy assistant modifiers do apply. When the PT is involved for the entire duration of the service and the PTA provides skilled therapy alongside the PT, the CQ modifier isn't required.

Beginning with dates of service on and after January 1, 2020, the discipline specific therapy modifiers (GO for OT and GP for PT) are still required to be appended to every CPT code billed to the Medicare program. The new PTA and OTA modifiers will be required in addition to the GO and GP modifiers.

MIPS is still expanding with new added measures for: diabetic foot and ankle care; peripheral neuropathy: neurological evaluation and prevention evaluation of footwear; screening for clinical depression and follow-up plan; falls screening and plan of care, elder maltreatment screen and follow-up plan; preventive care and screening: tobacco use: screening and cessation intervention; dementia: cognitive assessment, functional status assessment, and education and support of caregivers for patients with dementia; falls: screening for future fall risk; and functional status change for patients with neck impairment. The rule also removes 2 measures: pain assessment and follow-up, and functional status change for patients with general orthopedic impairments.

These are only a few of the updates included in the 2020 final rule. Other updates include new dry needling codes, updates to biofeedback, negative wound pressure coding values, and much more. Contact hello@lincolnrs.com to learn more about how the final rule updates will impact your clinicians and bottom line in the new year.

To learn more about the PFS Final Rule and the 2020 Quality Payment Program finalized policies, review the following resources directly from CMS:

Executive Summary – provides a high-level summary of the 2020 QPP final rule policies

Fact Sheet – offers an overview of the QPP policies for 2020 and compares these policies to the 2019 requirements

Frequently Asked Questions (FAQs) – addresses frequently asked questions about 2020 QPP final rule policies

MVPs Video – provides an overview of the MVPs participation framework

For PTs: The Buzz Around E Stim!

Below are the E Stim codes for Medicare. It is important to note that payment for these codes includes the cost of electrodes. It is important to read these definitions carefully to understand which code is appropriate.

It is also important to understand that not all commercial payers use the Medicare e-stim codes. Some commercial payers will only accept the 97014 (or other) codes. If you plan to utilize e-stim in your plan of care, it is important to verify up front with the patients benefits the billing guidelines for this code for that specific payer.

We know this can be extremely confusing. LRS is here to help you navigate your coding challenges. Feel free to give us a call with any questions you have!